Have you ever pondered how AI might change the way we operate? With its state-of-the-art humanoid robots, Figure AI is bringing that vision to life, and the buzz surrounding “figure ai stock” is getting stronger every day. We’ll examine the company’s history, technological advancements, market potential, and investment options in this in-depth piece. Continue reading to find out why Figure AI is a name to watch in the field of advanced robotics, regardless of whether you are an accredited investor or just interested in how AI is transforming businesses.

The next parts will cover Figure AI’s history, innovative products, pre-IPO stock exposure strategies, and market trends pertaining to the future of AI-driven business automation. Let’s get started.

A Brief History of Figure AI

Brett Adcock, an entrepreneur, founded Figure AI in 2022 with the lofty objective of creating the first autonomous humanoid robot that could be sold commercially. With the help of a group of professionals who had previously worked for well-known firms like Boston Dynamics and Tesla, the startup immediately gained recognition in the robotics and artificial intelligence fields.

- Founding and Vision:

The idea behind Figure AI was to replace dangerous manual labor with intelligent robotic devices in order to alleviate labor shortages and hazardous working conditions. - Early Funding and Growth:

Parkway Venture Capital spearheaded the company’s initial $70 million fundraising effort in May 2023. This initial investment demonstrated a significant belief in the company’s mission. - Major Funding Milestone:

The breakthrough occurred in February 2024 when Figure AI obtained a staggering $675 million in venture funding from a group of prominent investors, including Microsoft, Nvidia, Intel, Jeff Bezos, and the startup businesses of Amazon and OpenAI. The company was valued at an incredible $2.6 billion in this round, making it a unicorn.

Investors who are keen to obtain a piece of the robotics future are very interested in Figure AI because of its quick ascent. Even though “figure ai stock” isn’t yet listed on public exchanges, there is a noticeable buzz around the business.

Technological Innovations Driving Figure AI

The company’s unrelenting pursuit of innovation is one of the primary causes of the increasing interest in figure AI stock. Two innovative items created by Figure AI are prime examples of the upcoming generation of humanoid robots driven by AI.

Figure 01: The Pioneer Prototype

The company’s first humanoid robot, a bipedal device made to perform manual labor duties in sectors like warehousing and transportation, was Figure 01. Important characteristics include:

- Human-Like Dexterity:

The robot can function in settings intended for humans because of its design, which imitates human form elements. - Advanced Sensors and Perception:

Figure 01’s numerous cameras and sensor arrays allow it to easily explore challenging areas. - AI Integration:

The foundation for more sophisticated models was laid by early versions that combined fundamental machine learning algorithms to maximize task performance.

Figure 02: The Next-Gen Industrial Workhorse

A major advancement was made in August 2024 when Figure AI revealed Figure 02, the company’s next-generation humanoid robot. What distinguishes Figure 02 is as follows:

- Sleeker, Slimmer Design:

Figure 02 is more aesthetically beautiful and more functionally superior due to its integrated cabling and more ergonomic design. - Enhanced Battery Capacity:

A 50% increase in battery life allows for longer operating times, critical for industrial applications. - Superior Vision and Audio Capabilities:

It has three times the processing capability of its predecessor thanks to six RGB cameras and an onboard vision language model. Natural conversational exchanges are made possible by integrated microphones and speakers as well as a unique AI model created in partnership with OpenAI. - Improved Manipulation:

With 16 degrees of freedom and the ability to manage objects up to 25 kg, the new five-fingered robotic hands are perfect for intricate manufacturing and logistics jobs. - Real-World Deployment:

At a BMW facility in South Carolina, Figure 02 is currently undergoing testing and gathering crucial data to enhance its AI skills.

In addition to pushing the boundaries of robotics, these technical developments highlight the reasons why many investors are enthusiastic about the potential of figure ai stock.

The Investment Case for Figure AI Stock

There are several avenues for investors, particularly accredited ones, to have exposure to Figure AI, despite the fact that it is currently privately held and that its stock is not listed on public markets such as the NYSE or Nasdaq. A closer look at the investment environment is provided below:

Direct Investment in Private Shares

Secondary markets that enable the purchase and sale of pre-IPO shares let accredited investors to make direct investments in figure AI stock. Access to private company stock, including shares of Figure AI, is made possible by platforms like Forge, Hiive, and EquityZen. These markets give investors the opportunity to:

- Purchase Shares Directly:

Buy from existing shareholders, which may include early employees or venture capital firms. - Engage in Pre-IPO Transactions:

Secure liquidity before an eventual public offering.

Indirect Investment via Venture Funds

You might think about investing indirectly if you’re not an accredited investor or if you’d rather take a more diversified approach. Figure AI is owned by a number of investment vehicles and venture funds. For instance:

- ARK Venture Fund:

This fund includes Figure AI in its portfolio, offering exposure to the company’s growth without the need for direct investment in private shares. - Other Public Investment Vehicles:

Some ETFs and mutual funds focus on cutting-edge technology and robotics, and they may indirectly benefit from Figure AI’s success.

IPO Prospects and Future Liquidity

Even though Figure AI has grown and innovated a lot, it will still be years before it goes public. As it expands and improves its offerings, the business is probably going to stay a private firm. Retail investors may, however, have the opportunity to purchase figure AI stock on public markets once the IPO process starts. The pre-IPO market continues to be the principal avenue for investment until that time.

Market Trends and the Future of AI-Driven Robotics

There is more to the fervor over figure AI stock than meets the eye. The potential for AI-powered robotics to transform sectors and open up new investment opportunities is highlighted by a number of more general market trends.

The Labor Shortage Crisis

- Rising Demand for Automation:

Across manufacturing, warehousing, and logistics, companies are grappling with significant labor shortages. Humanoid robots like those developed by Figure AI offer a viable solution by taking over dangerous or tedious tasks. - Improved Safety and Efficiency:

Replacing humans in hazardous roles not only increases workplace safety but also boosts overall efficiency and productivity.

The AI Revolution in Business

- Integration of AI in Core Processes:

Businesses are increasingly incorporating AI into everyday operations. From optimizing supply chains to enhancing customer service, AI is becoming indispensable. - Partnerships with Tech Giants:

Figure AI’s collaboration with OpenAI, BMW, and other industry leaders is a testament to the growing importance of AI-driven solutions in business settings.

Investment in Data Infrastructure and AI Hardware

- Capital Expenditure Surge:

Big Tech companies like Nvidia, Microsoft, and Amazon are investing heavily in AI infrastructure. This trend supports the development of more sophisticated AI models and, by extension, more capable humanoid robots. - Supply Chain Innovation:

The advancements in robotics are part of a broader shift in supply chain dynamics, where automation is key to maintaining competitive advantages in a rapidly evolving market.

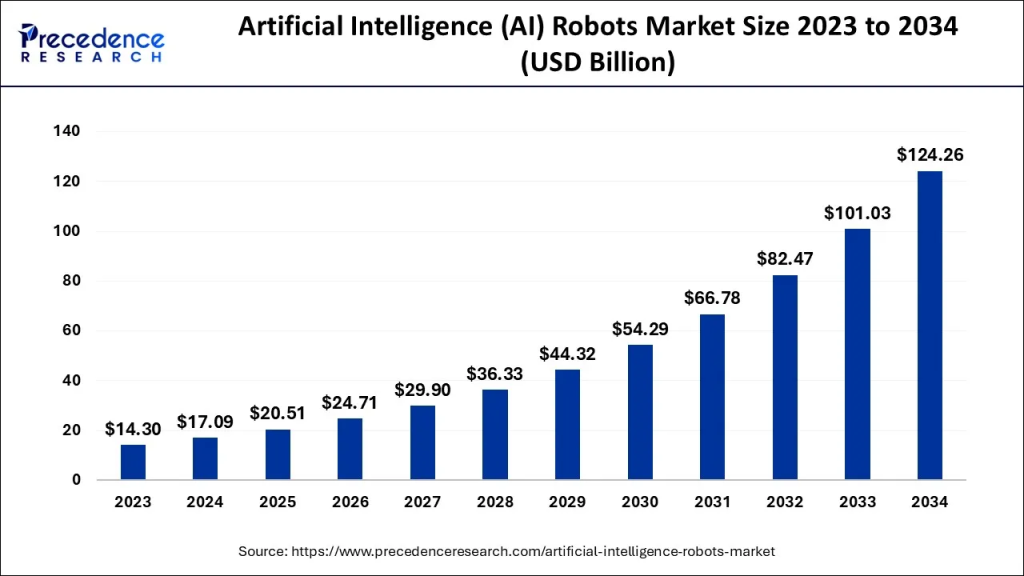

The Growth of the Humanoid Robotics Market

The market for humanoid robotics is expected to increase dramatically over the next ten years, according to industry predictions. According to certain estimates, the market may grow from a small starting point to tens of billions of dollars, propelled by:

- Technological Improvements:

As hardware and software capabilities improve, humanoid robots will become more affordable and versatile. - Increased Adoption:

Early adopters in industries like automotive, healthcare, and logistics are paving the way for wider implementation.

All these trends contribute to a favorable outlook for companies like Figure AI. Investors who recognize these shifts early could benefit from the long-term growth potential of AI-driven robotics.

Risks and Considerations for Investors

Investing in figure AI stocks has its own set of risks and difficulties, just like any other high-growth, high-innovation industry. Before getting started, it’s crucial to thoroughly analyze these factors.

Liquidity Challenges

- Private Market Limitations:

Since Figure AI is privately held, its shares are less liquid than those of public companies. This can make it harder to buy or sell shares quickly. - Pre-IPO Uncertainties:

The timeline for an IPO is uncertain. Investors may need to wait several years before the company goes public, during which time their capital could be tied up.

Valuation Risks

- High Expectations:

The impressive valuation of $2.6 billion reflects significant investor optimism, but it also sets high performance expectations. Any delay in product rollout or revenue generation could impact the company’s perceived value. - Market Volatility:

Emerging tech companies often experience volatile valuations, especially in sectors driven by rapid innovation and shifting market dynamics.

Execution Risks

- Technological Hurdles:

While Figure AI has made significant strides, developing fully autonomous, commercially viable humanoid robots remains a formidable challenge. Technical issues or delays in scaling production could affect the company’s growth trajectory. - Competitive Landscape:

The robotics and AI market is highly competitive. Established players and new entrants alike are racing to capture market share. Figure AI will need to continuously innovate to maintain its edge.

Regulatory and Ethical Concerns

- Privacy and Safety Regulations:

As AI and robotics become more integrated into society, regulatory scrutiny is likely to increase. Compliance with emerging safety, privacy, and labor regulations could pose additional challenges. - Ethical Considerations:

The deployment of humanoid robots raises ethical questions about job displacement and the human impact of automation. Companies will need to address these concerns transparently to maintain public trust.

Investors should conduct thorough due diligence and consider these risks in the context of their overall investment strategy. Diversification and a long-term perspective are essential when investing in high-growth, innovative sectors.

How Figure AI is Shaping the Future of Business

Notwithstanding the dangers, Figure AI has a strong chance to upend established corporate structures and promote notable advancements in safety and productivity. The company’s technologies have the potential to revolutionize the following industries:

Enhancing Workplace Safety

- Reducing Hazardous Labor:

By deploying humanoid robots to perform dangerous tasks, companies can significantly reduce workplace injuries. This not only protects workers but also reduces costs related to compensation and downtime. - Consistent Performance:

Robots can work tirelessly and consistently, ensuring that high-risk tasks are performed with precision and reliability.

Boosting Operational Efficiency

- Streamlined Operations:

With the ability to learn and adapt in real time, Figure AI’s robots can optimize workflows, reduce errors, and enhance overall operational efficiency. - Scalability:

As businesses grow, the demand for automation increases. Figure AI’s scalable solutions can help companies keep pace with expanding operations without the proportional increase in labor costs.

Transforming Supply Chain Management

- Automation in Logistics:

From warehouse management to last-mile delivery, the integration of humanoid robots can streamline supply chain processes, reducing delays and improving customer satisfaction. - Data-Driven Decision Making:

The advanced sensors and AI models embedded in Figure AI’s robots enable real-time data collection. This data can be used to fine-tune operations and forecast future demands more accurately.

Driving Innovation Across Industries

- Manufacturing:

In automotive and electronics manufacturing, precision and speed are critical. Humanoid robots can handle intricate assembly tasks, reducing defects and boosting production rates. - Healthcare:

In hospitals and care facilities, robots can assist with routine tasks such as delivery of medications and supplies, allowing medical professionals to focus on patient care. - Retail:

Automated robots can manage inventory, assist with customer service, and even provide interactive experiences in retail environments.

Figure AI’s focus on creating intelligent, adaptable humanoid robots positions it as a key player in the AI for Business revolution. The company’s products aren’t just cool gadgets—they’re practical tools that could redefine how businesses operate in the future.

Practical Investment Tips for Aspiring Investors

For those intrigued by figure ai stock and looking to get involved, here are some practical tips:

- Stay Informed:

Keep up with the latest news and updates from Figure AI. Follow the company’s press releases, industry news sites, and pre-IPO marketplaces. - Network with Experts:

Engage with investment platforms that specialize in private equity and pre-IPO investments. These platforms often host webinars, Q&A sessions, and networking events with industry experts. - Consider Indirect Exposure:

If you’re not eligible to invest directly, consider venture funds or ETFs that include Figure AI among their holdings. This way, you can gain exposure while diversifying your investment portfolio. - Evaluate Long-Term Potential:

Investing in early-stage technology companies requires a long-term perspective. Assess the company’s vision, technological innovations, and strategic partnerships rather than expecting immediate returns. - Diversify Your Portfolio:

While the promise of figure ai stock is exciting, always ensure your portfolio is diversified. Balancing high-risk investments with more stable assets can help mitigate potential losses.

Conclusion: Embracing the Future with Figure AI Stock

Figure AI is a sign of the future of labor, not just a robotics startup. The company is well-positioned to address some of the most urgent issues in labor-intensive industries by fusing cutting-edge AI with humanoid robotics. Despite the obvious dangers associated with investing in figure AI stocks, the potential returns are just as substantial.

The company’s rapid growth, large fundraising rounds, and innovative technological developments all serve to showcase its promise. As businesses around the world struggle with a shortage of people and strive for greater productivity, Figure AI’s solutions may become indispensable. This gives investors the opportunity to take part in a technological revolution that might revolutionize entire industries.

Platforms that give access to private market shares may offer a method for accredited investors with a penchant for high-growth, high-risk possibilities to get involved in this game-changing business. Observing Figure AI and the larger developments in AI-driven robotics can help you plan your long-term investment strategy, even if you are not now able to make direct investments.

In the coming years, as Figure AI continues to refine its products and potentially prepares for an IPO, its impact on the global business landscape is likely to grow. Whether you’re fascinated by the prospect of AI-powered humanoid robots or you’re looking for innovative investment opportunities, Figure AI represents a compelling case study in how technology can reshape our future.

Now is the time to learn more, connect with experts, and consider how the evolution of AI in robotics might influence your investment decisions. After all, being ahead of the curve in technology investments often means looking beyond today’s headlines to see the potential of tomorrow.

So, what do you think about the future of figure ai stock? Are you excited by the promise of intelligent robots taking on tasks that were once exclusively human? Share your thoughts, explore the opportunities, and join the conversation about the next big wave in AI-driven business transformation.

Ready to dive deeper into the world of AI and robotics? Subscribe to our newsletter for regular updates, expert insights, and practical tips on navigating the evolving landscape of tech investments. With Figure AI at the forefront, the future of work is here—and it’s powered by intelligent machines.

By blending innovation, business acumen, and technological breakthroughs, Figure AI is setting the stage for a new era of automation. Its products have already begun to make a real-world impact, and the potential for growth in the humanoid robotics market is enormous. For investors who are willing to take a long-term view and navigate the inherent risks of early-stage technology, figure ai stock offers a unique opportunity to be part of something transformative.

As always, if you decide to explore investment opportunities in emerging technologies like Figure AI, make sure to perform your own due diligence and consult with financial advisors to ensure your investment strategy aligns with your goals. The path to innovation is rarely smooth, but for those who can weather the challenges, the rewards could be substantial.

Join us on this journey into the future of work—where artificial intelligence and human ingenuity combine to create solutions that were once the stuff of science fiction. The era of AI-powered humanoid robots is upon us, and Figure AI is leading the charge. Stay curious, stay informed, and keep an eye on the horizon for the next big breakthrough in tech.

We’d love to hear your thoughts on Figure AI and its potential to reshape industries. Comment below, share your insights on social media, or reach out directly to join the conversation about the exciting future of figure ai stock.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in private companies and early-stage technologies involves a high degree of risk, including the potential loss of your investment. Always conduct your own research and consider consulting a financial advisor before making any investment decisions.